Confirming expectations, this week right wing candidate Jair Bolsonaro handily won the second round of the Presidential elections in Brazil, against left wing candidate Fernando Haddad, with a 55% to 45% majority. The President elect was swept to power on the back of anti-incumbent sentiment, fears about security, and a backlash against the left and the corruption scandals that have paralyzed much of the country for the past years

An ex-military man and longtime member of congress, Bolsonaro’s past track record is rather basic. However, his recent apparent adoption of pro-market views, and appointment of Paulo Guedes, a well-known University of Chicago trained economist who is one of the founders of what is now BTG, the largest Brazilian investment bank, and a successful Private Equity investor, has done much to calm the financial markets and certain parts of the business community. Guedes has no government experience however, and it remains to be seen if the relationship with the reportedly short-tempered president elect remains workable.

President Bolsonaro’s immediate challenge will be to deal with a fragmented congress, and obtain backing for much needed reforms on the social security, fiscal and tax fronts. His party (PSL) elected 51 congressmen and became the second largest block in congress, but that is still significantly below what is needed to approve reforms.

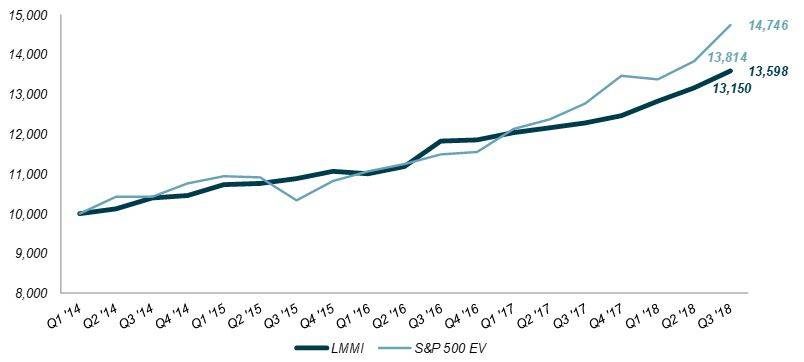

Looking ahead, it is highly probable that the financial markets will react favorably to the outcome, after initial profit taking right after the election.

We believe Bolsonaro will have a window of opportunity to achieve some of his (still unclear) objectives, as inflation pressure is low. FX volatility should decrease in the short term and the weak economic recovery will continue to pick up as low interest rates impact reach small and midcap companies. Approving the social security reform shall be the priority, and this is seen as the main path to recover long term fiscal balance and credibility in the international markets.

We believe the Central Bank will remain relatively independent (and if there are attempts to modify that relationship then the repercussions could be immediate). It is said that invitations were sent to the current CB president to stay in office.

Uncertainty regarding future developments on the international front, such as the Paris Climate Treaty, and environmental issues (regarding which his followers have made controversial statements), will mean that, along with his outspoken conservative stance on social issues, Bolsonaro may continue to get a negative reaction from a significant portion of the foreign press.

However, we believe fears of a return of military government (or any attempts to corrupt democracy) are totally misplaced and that institutions in Brazil are robust, despite noise in the system and Bolsonaro`s somewhat authoritarian rhetoric.

Lincoln Perspective

On the M&A front, we expect the pause that preceded the elections to continue, as players assess the new government. However, we believe a pick-up in M&A activity should come on the back of positive developments in the first half of 2019, especially if such reforms are approved and agendas to reduce the public deficit are implemented. We do not expect changes in antitrust policy, and if recent modifications to the labor legislation remain in place, we see that as positive to investor activity.

The post M&A and Investment Climate Post Election of New Brazilian President appeared first on Lincoln International.